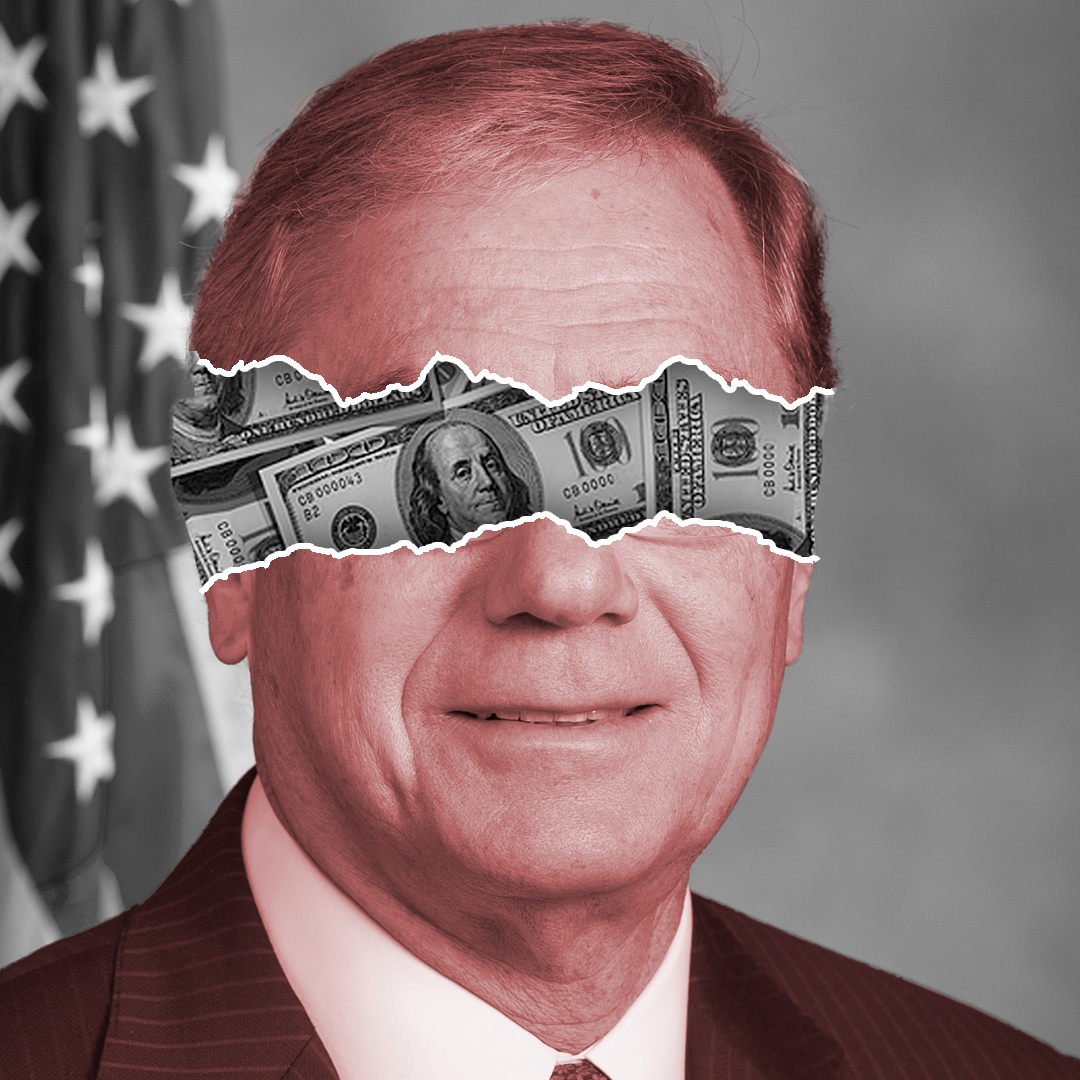

¶ Payday Lending Crony

Rep. Blaine Luetkemeyer has received nearly $250,000 from payday lenders over his career, the most of any sitting member of Congress. Rep. Luetkemeyer most notably led the charge against the Obama administration’s Operation Choke Point meant to crack down on the flow of money to fraudulent merchants, including the payday industry. Rep. Luetkemeyer has received nearly $90,000 coming from the American Financial Services Association, a trade association representing the high-cost lending industry that personally applauded Luetkemeyer’s efforts to stop the program.

¶ Rep. Luetkemeyer Has Received Nearly $250,000 From Payday Lenders, The Most Of Any Sitting Member Of Congress.

¶ Rep. Luetkemeyer Has Received Nearly $250,000 From Payday Lenders, The Most Of Any Sitting Member Of Congress.

According To OpenSecrets, Luetkemeyer Has Received Nearly $250,000 From The Payday Industry Over His Career, The 3rd Most Of Any Sitting Member Of Congress:

[OpenSecrets, accessed 01/30/23]

¶ Rep. Luetkemeyer Led The Charge Against Operation Choke Point Going As Far As Meeting With The FDIC’s Leadership To Extract Changes From The Program—Luetkemeyer Ultimately Received Nearly $300,000 From Industry Groups Most Opposed To Operation Choke Point, Including Over $43,000 From Gun Rights Groups And Over $247,000 From Payday Lenders

¶ Rep. Luetkemeyer “Led The Charge” Against Operation Choke Point—An Obama Administration Banking Policy That Cracked Down On The Flow Of Money To Fraudulent Merchants—Including Meeting With The FDIC’s Leadership And Successfully Pressuring The Agency To Adopt Some Policies He Proposed In His Pro-Industry, Financial Institution Customer Protection Act.

October 2018: Rep. Luetkemeyer Claimed To Have “Led The Charge” Against Operation Choke Point The Previous Five Years As He Announced Letters To The FDIC’s Then-Chairman Requesting Investigations Into The Policy And “Immediate And Firm Action” Into Certain Agency Staff Who “Abused Their Power.” “For the last five years, Congressman Blaine Luetkemeyer (MO-03), Chairman of the Financial Institutions and Consumer Credit Subcommittee, has led the charge against the aptly named ‘Operation Choke Point.’ On Friday, newly-unsealed court documents revealed additional information exposing the blatant intimidation and bias employed by Obama Administration bureaucrats. Today, Chairman Luetkemeyer sent letters to Federal Deposit Insurance Corporation (FDIC) Chairman Jelena McWilliams and Comptroller of the Currency Joseph Otting, calling on them to investigate this matter and take immediate and firm action against any member of their staff who has abused their power.” [Rep. Blaine Luetkemeyer, 10/15/18]

- August 2017: The End Of “Operation Choke Point,” An Obama-Era Justice Department Initiative That Discouraged Banks From Doing Business With Controversial Businesses Like Payday Lenders And Gun Sellers, Was Seen A “Big Victory” For Republican Lawmakers. “The Justice Department has committed to ending a controversial Obama-era program that discourages banks from doing business with a range of companies, from payday lenders to gun retailers. The move handed a big victory to Republican lawmakers who charged that the initiative — dubbed ‘Operation Choke Point’ — was hurting legitimate businesses.” [Politico, 08/17/17]

- June 2014: A Group Of Consumer Advocates Led By Americans For Financial Reform Urged Lawmakers To Oppose Gutting Operation Choke Point As It Was Crucial To "Ensure Banks And Payment Processors Comply With Longstanding Due Diligence Requirements" And That “We Need Every Tool To Fight Data Breaches, Identity Theft, Scams, Frauds, Money Laundering, And Other Illegal Conduct." "Americans for Financial Reform and the undersigned community, consumer, civil rights and labor groups urge you to support efforts to ensure that banks and payment processors comply with longstanding due diligence requirements so that they can avoid facilitating illegal activity by knowing their customers, monitoring return rates, and being alert for suspicious activity. Please oppose any effort to block funding for the Department of Justice’s Operation Choke Point or to weaken other regulator efforts to fight payment fraud. We need every tool to fight data breaches, identity theft, scams, frauds, money laundering, and other illegal conduct." [Americans for Financial Reform, 06/18/14]

Rep. Luetkemeyer Introduced Four Versions Of The Financial Customer Protection Act—Legislation To Dictate That The FDIC And Other Regulators Cannot Order Financial Institutions To End Banking Relationships With Certain Businesses—In 2014, 2016, 2017, And 2019, With The 2016 And 2017 Versions Passing The U.S. House. [Congress.gov, accessed 12/21/22]

- The Financial Institution Customer Protection Act Would Dictate That The Federal Deposit Insurance Corporation (FDIC) And The Office Of The Comptroller Of The Currency (OCC) Could Not Order A Financial Institution To Terminate A Banking Relationship Without “A Material Reason.” “The Financial Institution Customer Protection Act would dictate that agencies such as the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency, among others, cannot request or order a financial institution to terminate a banking relationship unless the regulator has material reason. Any account termination requests or orders would be required to be made in writing and rely on information other than reputational risk. In addition, the legislation strikes the word ‘affecting’ in the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), replacing it with ‘by’ or ‘against.’” [Rep. Blaine Luetkemeyer, 02/04/16]

January 2015: Rep. Luetkemeyer Met With The FDIC’s Then-Chairman And Vice Chairman To Discuss Operation Choke Point, Stating “‘Today Is A Turning Point In The Fight Against’” The Policy After He Said The FDIC Officials “‘Acknowledged Wrongdoing’” And Accepted Policies Luetkemeyer Had Proposed In His Financial Institution Customer Protection Act. “U.S. Rep. Blaine Luetkemeyer (MO-03) released the following statement after his meeting earlier today with Federal Deposit Insurance Corporation Chairman Martin Gruenberg and Vice Chairman Tom Hoenig discussing the agency’s involvement in Operation Choke Point: ‘Today is a turning point in the fight against Operation Choke Point. This morning, I met with Chairman Gruenberg and Vice Chairman Hoenig to discuss the FDIC’s activity with Operation Choke Point. Not only did the Chairman and the Vice Chairman acknowledge wrongdoing within the organization, but they have accepted many of the policies put forth in my legislation, the Financial Institution Customer Protection Act.’” [Rep. Blaine Luetkemeyer, 01/28/15]

February 2015: After The FDIC Agreed To Implement Parts Of His Financial Institution Customer Protection Act, Rep. Luetkemeyer Reintroduced The Bill To “Ensure The Changes Are Codified Into Law,” Claiming The FDIC’s Actions Were “‘Not Enough.’” “Following steps by the Federal Deposit Insurance Corporation (FDIC) to implement components of legislation he introduced last Congress, U.S. Rep. Blaine Luetkemeyer (MO-03) reintroduced the Financial Institution Customer Protection Act to ensure the changes are codified into law and applied to all federal banking regulators. Last week, Luetkemeyer met with FDIC Chairman Martin Gruenberg and Vice Chairman Tom Hoenig and the senior officials told Luetkemeyer they accepted many of the policies contained in his legislation and agreed to implement them.” [Rep. Blaine Luetkemeyer, 02/05/15]

- Luetkemeyer Said “‘While Steps Have Been Made In The Case Against Operation Choke Point, There Is Still A Need For My Legislation To Be Reintroduced This Congress,’” Calling The FDIC’s Agreement To Implement Some Of His Policies “‘Not Enough.’” “‘While steps have been made in the case against Operation Choke Point, there is still a need for my legislation to be reintroduced this Congress,’ Luetkemeyer said. ‘While I am pleased the FDIC is implementing parts of my legislation, it is not enough. I am reintroducing the Financial Institution Customer Protection Act because this legislation needs to be codified into law so that other agencies don’t ever fall into this illegal and abusive practice. Now that the FDIC has made it clear the agency has been involved in Operation Choke Point, I hope members on both sides of the aisle see the importance of my legislation because all of my colleagues have constituents at home who could be impacted by this program.’” [Rep. Blaine Luetkemeyer, 02/05/15]

- Luetkemeyer Said His Updated Version Of The Financial Institution Customer Protection Act Would Prevent The FDIC And Federal Agencies From Ordering A Financial Institution To Terminate Banking Relationships With Certain Businesses Unless There Is A “Material Reason.” “The Financial Institution Customer Protection Act would dictate that agencies such as the Federal Deposit Insurance Corporation and the Federal Reserve cannot request or order a financial institution to terminate a banking relationship unless the regulator has material reason.” [Rep. Blaine Luetkemeyer, 02/05/15]

¶ Rep. Luetkemeyer Has Received Nearly $300,000 From Industry Groups Most Opposed To Operation Choke Point, Including Over $43,000 From Gun Rights Groups And Over $247,000 From Payday Lenders, With Nearly $90,000 Coming From The American Financial Services Association Which Personally Applauded Luetkemeyer’s Efforts To Stop The Program.

Over His Congressional Career, Luetkemeyer Has Received At Least $290,650 From Payday Lenders And Gun Rights Groups, Industries That Were The Most Opposed To Operation Choke Point.

- Over His Congressional Career, Luetkemeyer Has Received $43,250 From Gun Rights Groups. [Opensecrets, accessed 01/19/23]

- Over His Congressional Career, Luetkemeyer Has Received $247,400 From Payday Lenders, The Most Of Any Sitting Member Of Congress. [Opensecrets, accessed 01/19/23]

The National Rifle Association’s Institute For Legislative Action Has Criticized Operation Choke Point As One Of The “Most Insidious” Scandals Of The Obama Administration. “Of all the scandals of the anti-gun Obama/Biden administration, Operation Chokepoint was perhaps the most insidious. NRA-ILA covered the story at the time, explaining how federal regulators – including the Department of Justice and the Federal Deposit Insurance Corporation (FDIC) – used their authorities to intimidate banks into shunning lawful but politically disfavored industries. Among those industries were firearms and ammunition retailers, many of which lost the access to capital and credit they needed to do business. The chairman of the FDIC at the time was Martin J. Gruenberg.” [NRA-ILA, 11/21/22]

July 2014: Consumer Credit Industry Group, The American Financial Services Association Wrote A Letter To Rep. Luetkemeyer Praising His Introduction Of Legislation Ending Operation Choke Point While Applauding His “Efforts To Provide A Safe Harbor For Banks And Credit Unions Legally Providing Legitimate Businesses With Access To Critical Financial Services.” On behalf of the American Financial Services Association (AFSA) and our more than 350 members, I write in support of your legislation, H.R. 4986, the End Operation Choke Point Act of 2014. AFSA is the national trade association for the consumer credit industry, protecting access to credit and consumer choice. Our members include consumer and commercial finance companies, auto finance/leasing companies, mortgage lenders, mortgage servicers, credit card issuers, industrial banks and industry suppliers. We applaud your efforts to provide a safe harbor for banks and credit unions legally providing legitimate businesses with access to critical financial services as well as a vehicle to end what is a dangerous and unprecedented use of bureaucratic authority.” [AFSA, 07/24/14]

- Since 2010, AFSA Has Donated $89,500 To Rep. Luetkemeyer Alone. [FEC, accessed 01/19/23]

¶ Rep. Luetkemeyer Supported Legislation Making It Easier For Payday Lenders To Avoid State Interest Rate Caps.

¶ Rep. Luetkemeyer Voted For The Protecting Consumers’ Access To Credit Act, Legislation That Over 150 Organizations Urged Congress To Reject Because It Would Expand “Rent-A-Bank” Arrangements Allowing High-Cost Lenders To Avoid State Interest Rate Caps.

February 2018: Rep. Luetkemeyer Voted For The Protecting Consumers’ Access To Credit Act Of 2017, Which Passed The House With A Vote Of 245-171. [Clerk of the U.S. House of Representatives, 02/14/18]

September 2017: The Center For Responsible Lending (CRL) And 150 Organizations Urged Congress To Reject H.R. 3299, The Protecting Consumers’ Access To Credit Act Of 2017, Arguing It Would Make It Easier For Predatory Lenders To “Use Rent-A Bank Arrangements To Ignore State Interest Rate Caps And Make High-Rate Loans.” “The Center for Responsible Lending (CRL), the National Consumer Law Center (NCLC), and 150 national and state organizations urge Members of Congress to reject S. 1642 and H.R. 3299, legislation that pose serious risks of enabling a vast expansion of predatory lending across the country. Specifically, the legislation makes it easier for payday lenders and other nonbanks to use rent-a-bank arrangements to ignore state interest rate caps and make high-rate loans.” [Center for Responsible Lending, 09/11/17]

- CRL And The Other Organizations Noted The Legislation Could Undermine Interest Rate Caps In 15 States And The District Of Columbia That Save Consumers Over $2.2 Billion In Payday Loan Fees Per Year. “The potential costs and damage to consumers are significant, the groups warn. S. 1642 and H.R. 3299 could potentially expand short-term payday lending to the 15 states plus the District of Columbia whose state interest rate limits currently save borrowers over $2.2 billion annually in payday loan fees.” [Center for Responsible Lending, 09/11/17]