¶ McHenry's Finance Industry Money

Rep. Patrick McHenry has taken over $5 million from the broad financial industry over his career, including over $2.6 million from the securities & investment industry, over $1.6 million from commercial banks, and $780,000 from the finance & credit industry. Rep. McHenry has notably taken over $700,000 from just three major banks that made over $6.8 billion in overdraft fees in 2019 alone and industry groups who opposed efforts to rein in overdraft practices.

¶ Rep. McHenry Has Taken Over $5 Million From The Financial Industry Over His Career.

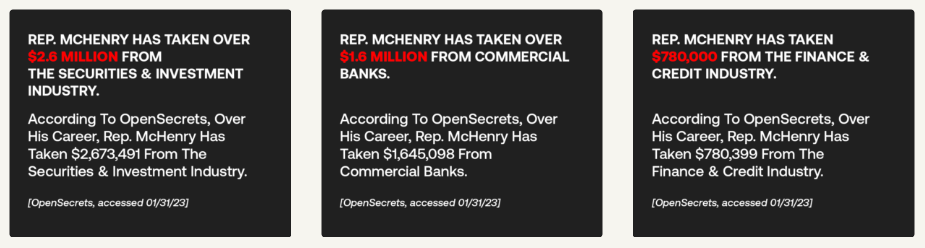

¶ Rep. McHenry Has Taken Over $2.6 Million From The Securities & Investment Industry.

According To OpenSecrets, Over His Career, Rep. McHenry Has Taken $2,673,491 From The Securities & Investment Industry. [OpenSecrets, accessed 01/31/23]

¶ Rep. McHenry Has Taken Over $1.6 Million From Commercial Banks.

According To OpenSecrets, Over His Career, Rep. McHenry Has Taken $1,645,098 From Commercial Banks. [OpenSecrets, accessed 01/31/23]

¶ Rep. McHenry Has Taken $780,000 From The Finance & Credit Industry

According To OpenSecrets, Over His Career, Rep. McHenry Has Taken $780,399 From The Finance & Credit Industry. [OpenSecrets, accessed 01/31/23]

¶ Rep. McHenry Has Taken Over $700,000 From Just Three Major Banks That Made Over $6.8 Billion In Overdraft Fees In 2019 Alone And Industry Groups Opposed To Efforts To Rein In Overdraft Practices.

¶ Over His Career, Rep. McHenry Has Taken At Least $722,500 From The Three Largest Banks That Made Over $6.8 Billion In Overdraft Fees In 2019 And Industry Groups Opposed To Efforts To Rein In Overdraft Practices.

Over His Career, Rep. McHenry Has Received At Least $722,000 From The Three Largest Banks That Raked In Over $6.8 Billion In Overdraft Fees In 2019 And Leading Industry Groups Opposed To Overdraft Regulation:

| Bank/Trade Association. | Career Contributions* |

| Wells Fargo | $103,500 |

| JPMorgan Chase | $115,000 |

| Bank of America | $126,000 |

| Bank Policy Institute | $49,000 |

| Consumer Bankers Association | $62,500 |

| American Bankers Association | $148,000 |

| Independent Community Bankers of America | $113,500 |

| U.S. Chamber Of Commerce | $5,000 |

| TOTAL: | $722,500 |

*Total Includes Contributions To Sponsored Leadership PAC

- December 2021: The Consumer Financial Protection Bureau Released A Report Highlighting That JPMorgan Chase, Wells Fargo, And Bank Of America—Some Of The Largest Banks In The Country—Brought In Over 44% Of The Nearly $15.5 Billion In Overdraft Revenue Big Banks Made In 2019 Alone, A Total Of Over $6.8 Billion. [Consumer Financial Protection Bureau, 12/01/21]

March 2022: In A Comment Letter The CFPB's Fee Inquiry, BPI Defended Overdraft And Nonsufficient Fund Fees By Saying Not Charging A Fee "Could Harm The Safety And Soundness Of The Institution, Put[ting] Consumers At Risk" And That Providing The Service For Free Could Force Banks To Stop Offering Certain Products Or Charge More, Which "Could Be Harmful To Consumers." "Charging a flat fee would impose costs on some customers for products or services that they do not use. For example, charging all customers a flat fee that would include insufficient funds ('NSF') or overdraft fees would impose costs on some consumers that never overdraw, or attempt to overdraw, their account. Therefore, banks generally charge fees for (i) use of a particular product or service – for example, foreign ATM or safety deposit fees – in order to keep unavoidable charges low, and (ii) behavior that indicates risk – for example, NSF fees – that if provided free of charge could harm the safety and soundness of the institution, put consumers at risk of account closure or entering a debt spiral, or both. Further, if banks were not able to charge for services, or were limited as to the amount they could charge, the result could be harmful to consumers, as banks may simply cease offering certain products or services or charge more to consumers for other services.” [Bank Policy Institute, 03/31/22]

In A Letter To The House Subcommittee On Consumer Protection And Financial Markets, CBA Stated Overdraft Is "A Safe And Affordable Form Of Immediate Short-Term Liquidity" For Consumers. "The Consumer Bankers Association (CBA) submits this letter for the record for the hearing entitled 'The End of Overdraft Fees? Examining the Movement to Eliminate the Fees Costing Consumers Billions.' Overdraft is a safe and affordable form of immediate short-term liquidity used by millions of consumers to ensure they can continue to purchase necessary goods and services. As policymakers’ review the overdraft market, it is essential that a better understanding of consumer demand for the product, its use as a form of emergency liquidity and the evolution of the overdraft product by financial institutions is warranted before making any changes that could have unintentional consequences on low to moderate-income Americans." [Consumer Bankers Association, accessed 03/31/22]

May 4, 2022: In A Statement To The Senate Subcommittee On Financial Institutions And Consumer Protection, The ABA Defended Overdrafts As An "Important Source Of Liquidity," Claiming 89% Of Consumers Find Overdraft Protection "Valuable." "Overdraft protection services are an important source of liquidity for many Americans. With access to overdraft protection, bank customers can have confidence that they can pay their rent or utility bill, thereby avoiding late fees, a utility shut-off, or even eviction. For customers living paycheck to paycheck, access to overdraft provides significant value. The average transaction amount paid into overdraft was $198 in 2019, according to the research firm Curinos. Unsurprisingly, 9 in 10 consumers (89%) find their bank’s overdraft protection valuable, according to a February 2022 national survey by Morning Consult." [American Bankers Association, 05/04/22]

The U.S. Chamber of Commerce Has Repeatedly Stated Its Opposition To Overdraft Reform Legislation, Criticizing It As Making It "More Difficult For Consumers To Manage Their Finances," While Adding That "There Are Many Instances In Which Consumers Benefit From Overdraft Protection."

- June 14, 2022: The Chamber Of Commerce Stated Its Opposition To The Overdraft Protection Act, Claiming Overdraft Payments Are “Already Regulated” And That “There Are Many Circumstances In Which Consumers Benefit From Overdraft Protection.” “H.R. 4277, the Overdraft Protection Act […] This bill would make it more difficult for consumers to manage their finances by restricting the type of overdraft protection products that can be offered by financial institutions. Overdraft payment services are already regulated; consumers receive fee disclosures and are only eligible for overdraft protection if they opt-in to the service. Overdraft protection products are subject to a robust disclosure regime that informs consumers of the total fees to which they may be subject. The Truth in Savings Act, as implemented by Regulation DD, requires a depository institution to make specific disclosures for overdraft services. There are many circumstances in which consumers benefit from overdraft protection from their bank. The legislation also seems to disregard that consumers have many options for accounts that do not offer overdraft payment services.” [U.S. Chamber of Commerce, 06/14/22]

- November 2021: The Chamber Sent A Letter To The House Financial Services Committee In Opposition To Markup Of The Overdraft Protection Act, Arguing The Bill Would "Make It More Difficult For Consumers To Manage Their Finances" And That "There Are Many Instances In Which Consumers Benefit From Overdraft Protection." "This bill would make it more difficult for consumers to manage their finances by restricting the type of overdraft protection products that can be offered by financial institutions. […] There are many circumstances in which consumers benefit from overdraft protection from their bank. For example, it may help them make a payment on a debt obligation so they can avoid a late fee." [The U.S. Chamber Of Commerce, 11/15/21]

June 8, 2022: In A Letter To The House Financial Services Committee, ICBA Urged Congress To Reject The Overdraft Protection Act, Arguing Overdraft Restrictions Would Force Banks To Stop Offering Overdraft Services Which Would Result In “Significantly More Bounced Checks.” “The Overdraft Protection Act (H.R. 4277) […] H.R. 4277 contains overdraft restrictions that would force many community banks to stop offering overdraft services to their customers. Such restrictions would result in significantly more bounced checks and declined debit card transactions—leading to unnecessary credit rating harm. H.R. 4277 will not address or stop fees and additional consequences for missed or late payments levied by landlords, medical insurance, utility companies, childcare, and other payment stakeholders. ICBA urges the Committee to reject H.R. 4277.” [Independent Community Bankers Of America, 06/08/22]