¶ Rep. Andy Barr (R-Kentucky)

¶ FINANCE INDUSTRY MONEY

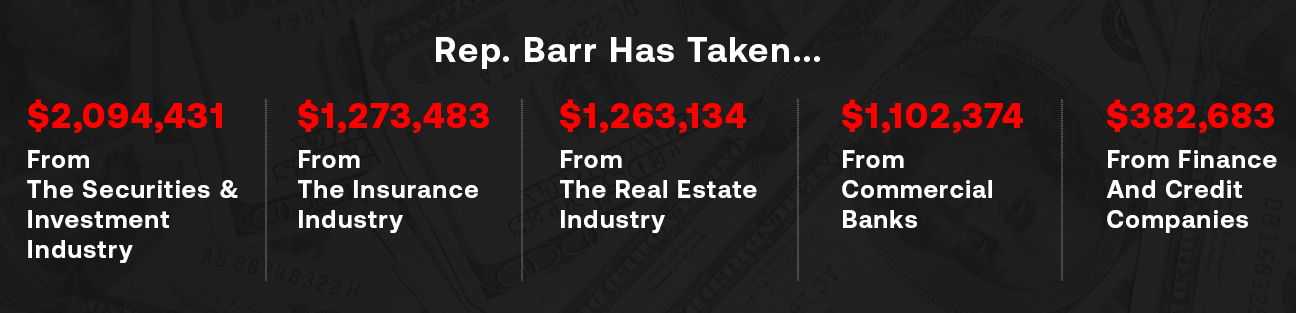

Rep. Andy Barr has taken over $6.8 million from the financial industry, far more than he has taken from other sectors. Barr’s campaigns have also benefited from almost $800,000 in spending by the National Association of Realtors, which paid for the site ThankYouAndyBarr.com for his pro-industry actions, including legislation he introduced to undermine consumer protections for mortgages.

¶ ANTI-CFPB CRUSADER

Rep. Barr has a long history of working to undermine the Consumer Financial Protection Bureau (CFPB). This includes repeatedly introducing legislation to “rein in” what he called “the largely unaccountable” CFPB and to help mortgage lenders “circumvent” certain consumer protections. Barr has also cosponsored bills to force the CFPB to “prioritize” financial institutions in issuing industry rules and to strike down a major CFPB rule that tried to help harmed consumers sue abusive financial companies. Barr’s voting record also includes supporting bills that would have had a “crippling effect” on financial regulation and to override regulators’ expertise.

¶ SUPPORTER OF DEREGULATING BANKS AND PAYDAY LENDERS

Rep. Barr has voted for legislation to help payday and other high-cost lenders avoid state interest rate caps. Additionally, Barr has also introduced a wide array of pro-industry legislation, including major rollbacks of protections stemming from the 2008 financial crisis and “dangerous loopholes” in a rule that prevented banks from “gambling” with consumers’ funds.

¶ CORPORATE ALLY

While in private law practice, Rep. Barr focused on “government entity defense” while at firms known for representing big business interests. Most notably, Barr repeatedly appeared as a lawyer for pharmaceutical giant Eli Lilly against consumer lawsuits alleging the company “induced” doctors to prescribe its drug Zyprexa for non-FDA approved uses and “purposefully minimized” the drug’s significant health hazards. Ultimately, Barr was on the wrong side of these cases, with Eli Lilly later agreeing to a $1.4 billion Justice Department settlement—which included “the largest criminal fine” against a single corporation—over improperly promoting Zyprexa’s off-label uses and at least $1.2 billion in separate settlements over understating the drug’s health risks.

Barr, whose biggest career political contributor is a major coal company, has also vocally defended the coal industry, even using his House Financial Services Committee position to pressure megabank CEOs to keep financing fossil fuels.