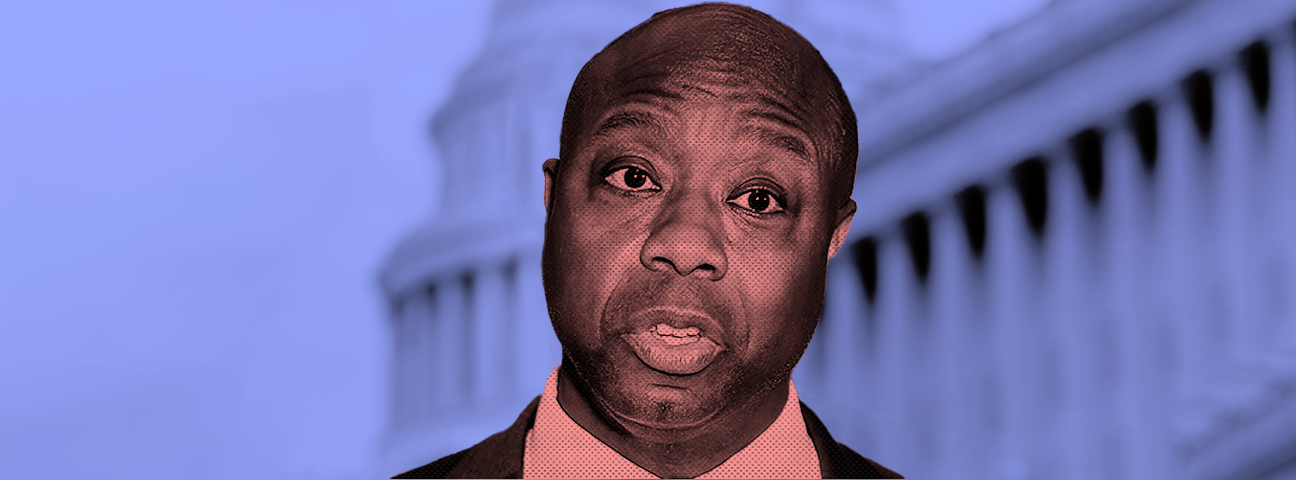

¶ Sen. Tim Scott (R-South Carolina)

¶ TIM SCOTT’S FINANCE INDUSTRY MONEY

Sen. Tim Scott has taken over $9.6 million from the finance, insurance, and real estate industries, far more than he has taken from other sectors. Sen. Scott’s major individual donors include over $3 million from billionaire debt collection magnate Benjamin Navarro, whose company drew controversy for boosting debtor lawsuits in the first months of the pandemic. Sen. Scott has also taken hundreds of thousands of dollars from hedge fund billionaires Paul Singer and Daniel Loeb, who is known for his “nasty” business tactics.

¶ ANTI-CFPB CRUSADER

Sen. Scott, who has opposed reining predatory loan interest rates, has a long history of opposing the Consumer Financial Protection Bureau. Sen. Scott has claimed the Bureau “lacks transparency” and has signed his name to several bills to undermine the CFPB, including one to strike down a rule making it easier for harmed consumers to sue abusive companies, one to make the Bureau “prioritize” business interest, and another to hobble the CFPB’s independence.

¶ SUPPORTER OF DEREGULATING THE FINANCIAL INDUSTRY

Sen. Scott has repeatedly worked to help the financial industry. This includes cosponsoring a major deregulation bill that successfully weakened post-2008 financial crisis reforms and voting against Trump administration rules that allowed predatory lenders to avoid state interest rate caps and undermined federal rules that incentivized banks to better serve low-income communities.

¶ CORPORATE ALLY

Sen. Scott was the “key” Republican sponsor of the Opportunity Zone tax break included in Trump’s 2017 tax overhaul, working closely with Trump’s family to advance the policy. This tax break was widely criticized for giving “massive tax benefits to wealthy investors” while failing to help struggling communities. Sen. Scott would go on to take hundreds of thousands of dollars from wealthy donors who stood to benefit from the Opportunity Zone break, including multiple NFL franchise owners and the chairman of the New Balance shoe company.

Sen. Scott has also taken tens of thousands of dollars from Boeing after pushing a major tax break for the company while Charleston County Council chairman and later introducing legislation to protect the company from labor regulators while in Congress. Scott, a real estate investor with a 50% interest in a residential real estate company in South Carolina, has received over $90,000 from major residential real estate industry PACs.